On July 6, PBGC released additional guidance on implementing the Special Financial Assistance (SFA) program of the American Rescue Plan Act (ARPA). The Final Rule provides additional clarity on aspects of the SFA program initially defined in an Interim Final Rule (IFR) and how PBGC will administer the program. Provisions of the Final Rule become effective August 8, 2022, with the guidance applicable under the IFR remaining in effect until that date.

Under the Final Rule, some aspects of the program have remained the same while others are changed or clarified based on comments received from the multiemployer community and other regulatory agencies. These comments identified areas needing refinement, practical considerations and challenges identified by plan service providers and trustees, and opportunities to improve the likelihood plans that receive SFA money remain solvent through and beyond 2051.

This Alert addresses what’s the same under the final rule, what’s changed, and transition considerations for multiemployer plans that have already applied to receive SFA funding.

What’s the Same?

There are various aspects of the SFA program that did not change with the issuance of the final rule. These include:

- Plan eligibility requirements for receiving SFA funds, which are set by statute in the ARPA legislation[1];

- The basic definition of Special Financial Assistance, which requires consideration of all of a plan’s financial resources and obligations;

- The basic application and review process established by PBGC, including the ability to withdraw an application and reapply; and

- The post-SFA approval reporting and monitoring period.

What’s Changed?

The PBGC made a variety of updates to the SFA program in the Final Rule, including addressing investment restrictions on SFA funds, the SFA calculation method, conditions placed on plans receiving SFA, and certain SFA application requirements.

Expansion of Permissible Investments

PBGC’s original guidance required all SFA assets to be invested in investment grade fixed income. The Final Rule relaxes that requirement to allow up to 33% of the SFA assets to be allocated to return-seeking investments such as stocks and equity mutual funds. The Final Rule requires plans to meet these asset allocation restrictions at the time of the initial investment purchase, with rebalancing required at least annually thereafter.

PBGC notes that permitting allocation of a portion of SFA assets to return-seeking investments strikes more of a balance between investment risk and return than the 100% fixed income allocation in the IFR. This allows plans to achieve a higher long-term return and increase their ability to project that they can remain solvent through 2051.

Interest Rates Used in the SFA Calculation

Considering the expansion of the permissible asset investments, PBGC modified the interest rate requirements for discounting projected plan cash flows in the SFA calculation. Under the IFR, a single investment return assumption was used to discount cash flows to be paid from plan assets, with no distinction made between expected returns on SFA and non-SFA assets. This created an “interest rate mismatch” between expected return on SFA assets and the return assumption used to discount cash flows paid from those assets, which in turn caused the amount of the calculated SFA to be insufficient to reasonably allow a plan to pay all benefits due through the 2051 plan year.

The Final Rule retains generally the same expected return assumption for non-SFA assets (with some minor technical changes to the determination of the interest rate cap) and defines a separate return assumption for SFA assets equal to the lesser of:

- The interest rate used by the plan for the funding standard account projections in the plan’s most recent zone certification before January 1, 2021[2], and

- The average of the published first, second and third segment rates[3] for the month in the four-month period preceding the month in which the SFA application is filed, which produces the lowest average, plus 67 basis points.

Use of a lower expected return assumption for SFA assets produces a larger SFA amount.

SFA Calculation for Plans that Implemented MPRA Suspensions

The IFR did not include any special provisions for determining the amount of SFA for plans that had previously implemented benefit suspensions under the Multiemployer Pension Reform Act of 2014 (MPRA). The Final Rule creates a different SFA calculation for these plans that recognizes the effect on future solvency that accompanies the reinstatement of suspended benefits. The SFA amount for these MPRA plans is the greatest of:

- The SFA amount for non-MPRA plans,

- The present value of reinstated benefits (including both makeup payments for past suspensions and the reinstatement of projected future benefits that would not have been paid under the suspension provisions[4]), and

- The amount needed to project increasing assets as of the end of the 2051 plan year.

Conditions Applicable After the Receipt of SFA

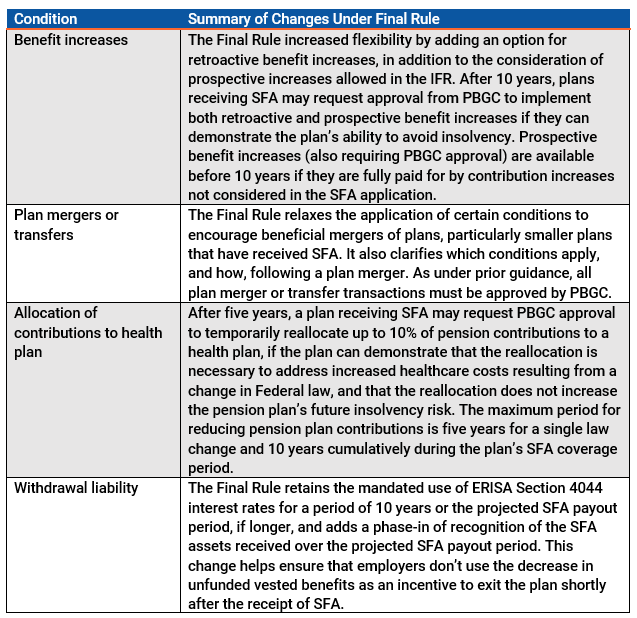

The Final Rule changes certain of the conditions placed on plans that receive SFA. These include:

Increased Flexibility in the Application Process

The metering system enacted by PBGC to ensure adequate resources for SFA application review has precluded some plans from submitting an application that establishes an SFA measurement date at the most beneficial date. The Final Rule allows for plans to submit a “lock-in” application so as not to be harmed by the metering process. The “lock-in” application requires submission of certain basic plan information and a statement of intent to lock in base data, with the remaining elements of the full application filed after the e-filing portal reopens.

The Final Rule also changes the measurement date to be the last day of the third calendar month preceding the application date (rather than the last day of the preceding calendar quarter).

Transition Between the IFR and Final Rule

The changes implemented by the Final Rule, including the new rules relating to expanded investment options and the use of the bifurcated investment return assumptions, are available to plan sponsors that have already applied for SFA if they submit a revised or supplemental application.

- Plans that have already received SFA will keep the money previously paid by PBGC and may qualify for additional SFA funding because of the changes in the Final Rule. Payment of supplemental amounts is not automatic and requires submission of a supplemental application. The base data does not change, and the calculations as of the original measurement date are updated to reflect the provisions of the Final Rule as though in effect at the time of the original application. The expanded investment options for SFA assets apply to both the original and supplemental SFA amounts.

- Plans with pending SFA applications have two options. They may withdraw their current application and resubmit under the Final Rule after August 7, 2022, or proceed with their original application under the IFR then, once approved, file a supplemental application under the Final Rule.

Updates to the PBGC’s American Rescue Plan Act FAQs page for the SFA Final Rule are still pending and should be posted soon. PBGC has made available updated templates for funds to use for submitting SFA applications, including the new supplemental filing available for some funds that have already been received or are in the application review process.

Contact a Bolton consultant to discuss how the changes enacted under the Final Rule will affect your plan.

[1] Program eligibility criteria were discussed in our March 2021 Alert on the passage of the American Rescue Plan Act.

[2] This is the same as the non-SFA interest assumption prior to the application of the interest rate cap of the IRC Section 430(h)(2)(C) third segment rate plus 200 basis points.

[3] The first segment rate is the average of rates on the published IRS corporate bond yield curve for periods up to five years, the second segment rate is the average of the yield curve rates for the next 15 years, and the third segment rate is the average of the yield curve rates for periods 20 or more years in the future. For this purpose segment rates are the 24-month average of the monthly spot rates, prior to reflecting interest rate stabilization provisions enacted after the original passage of the Pension Protection Act.

[4] The present value of reinstated benefits does not include any adjustable benefits that may have been cut under the terms of a rehabilitation plan.