Our June 2020 Bolton Insight described the proposed HEROES Act, which contained two significant funding relief items that would benefit single employer pension plans. Although that proposal did not become law at the time, those provisions along with provisions that address the funding crisis facing multiemployer pension plans have been revived in new legislation, the American Rescue Plan Act of 2021 (ARPA) which was signed into law on March 11, 2021.

Single Employer Provisions

Extended Amortization of Funding Shortfalls

Beginning with the Pension Protection Act of 2006 (PPA), funding shortfalls were amortized over a seven year period. Under ARPA, effective for plan years beginning in 2022, plans will be provided with a “fresh start” such that shortfall amortization bases and installments applicable to plan years prior to 2022 will be reduced to zero, and new funding shortfalls will be amortized over a fifteen year period. Plan sponsors may elect to adopt these changes retroactive to begin in the 2019, 2020, or 2021 plan years.

Unlike the temporary extended amortization period options provided in the Pension Relief Act of 2010 (PRA 2010), this fifteen year amortization period is a permanent change to the funding rules.

Extension of Pension Funding Stabilization Percentages

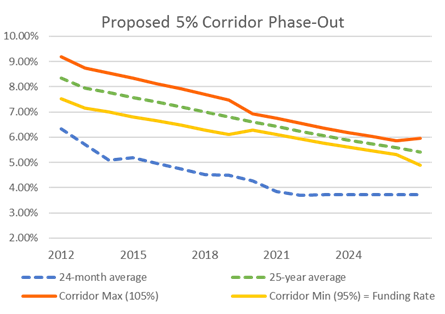

The Bipartisan Budget Act of 2015 (BBA), the most recent iteration of interest rate smoothing legislation, maintained the corridor around the twenty-five year average of the three segment rates beginning at 10% through the 2020 plan year with a gradual 5% per year expansion beginning in 2021, reaching 30% for plan years beginning in 2024 and later.

Under ARPA:

- The 10% interest rate corridor is reduced to 5% for plan years 2020 through 2025.

- The gradual 5% per year expansion to 30% will be delayed to the 2026 plan year, so that the maximum 30% corridor is reached in the 2030 plan year.

- A permanent 5% interest rate floor will be established for each of the three twenty-five year average segment rates before applying the floor.

Plan sponsors may elect to defer these changes until the 2022 plan year, for all purposes or just for determining the Adjusted Funding Target Attainment Percentage related to determining benefit restrictions, as specified in the election.

The effect of the modified phase-out of the interest rate corridor can be seen in the graphs below with the yellow line effectively representing the interest rates that would be used for funding:

Multiemployer Provisions

Special Financial Assistance

ARPA expands the authority of the Pension Benefit Guaranty Corporation (PBGC) to provide financial assistance for financially troubled plans who meet the following criteria:

- The plan is certified to be in Critical & Declining Status in any plan year beginning in 2020 through 2022.

- The plan has already been approved for a Suspension of Benefits under MPRA.

- The plan is certified to be in Critical Status in any plan year beginning in 2020 through 2022, has a modified funded percentage (on a current liability basis) less than 40%, and the ratio of actives to inactives is less than 2 to 3.

- The plan became insolvent after December 16, 2014 and has not been terminated as of the date of enactment of this legislation.

Under this new program, plan sponsors who apply for assistance will receive enough financial assistance to cover all benefits due for thirty years (through 2051), with no cuts to the earned benefits of participants, and without requiring the plans to repay the funds it receives back to the PBGC. Plans that previously cut benefits would be required to restore the benefits to the affected retirees and would not be eligible to apply for a new suspension of plan benefits.

Special funding assistance, and any earnings on such assistance, must be segregated from other plan assets and may only be invested in investment-grade bonds or other investments permitted by the PBGC.

Temporary Relief

- ARPA allows plans to temporarily delay the designation to endangered, critical, or critical and declining status by permitting them to retain their funding zone status for the plan year beginning in 2019 for the plan years beginning in 2020 and 2021. Plans in endangered or critical status do not have to update their plan or schedules until the first plan year beginning after March 1, 2021.

- Plans in endangered or critical status for a plan year beginning in 2020 or 2021 will be allowed to extend their funding improvement period or rehabilitation period by five years.

- Similar to relief following the 2008 financial crisis, plans would be allowed to amortize the investment and employment losses for the first two plan years ending after February 29, 2020 over a 30-year period.

Increase in PBGC Premiums

The Multiemployer Pension Reform Act of 2014 (MPRA), the most recent legislation to affect the multiemployer plan PBGC premium payments, doubled the then-current annual premiums to be set at $26 per participant in 2015 with annual increases thereafter for inflation, currently at $31 per participant in 2021. ARPA increases this annual premium to be $52 per participant beginning in plan years starting after December 31, 2030, increasing annually for inflation thereafter.

We will provide more information about the details of ARPA as regulations and guidance are released. Please contact Jim Ritchie at (443) 573-3924 and jritchie@boltonusa.com with any Single Employer questions or Tim Boles at (443) 573-3938 and tboles@boltonusa.com with any Multiemployer questions.

©2020, Bolton Partners, Inc.