Many positions in the public sector require specialized skills and a substantial amount of training. Filling these positions can be challenging and significant resources can be lost from employee turnover.

Public sector employers provide generous benefits, including traditional pension plans, to incentivize employees to stay in these positions for entire careers. However, private sector workforces have become more mobile and many of the same patterns and expectations are appearing in the public sector. This includes a desire for more portable retirement benefits.

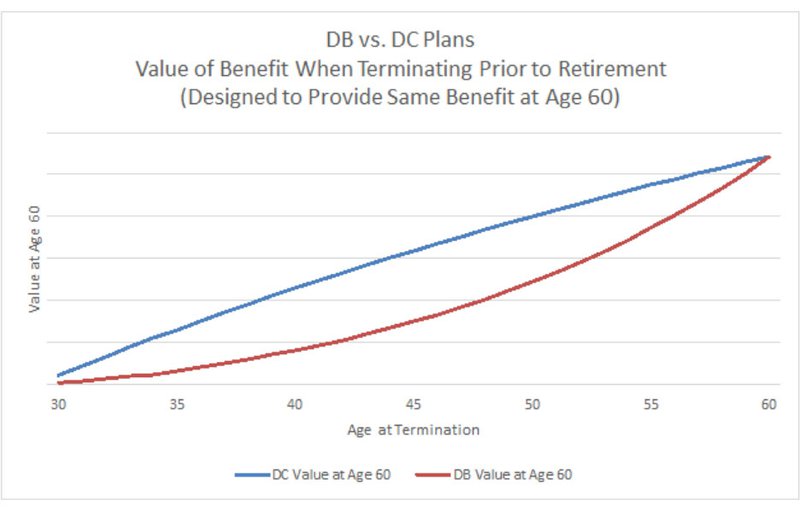

Defined Contribution (DC) plans (e.g. 401(k) plans) have become the norm in the private sector, with relatively few traditional Defined Benefit (DB) plans remaining. DC plans are easily portable between jobs and allow employees to accumulate retirement savings while working in several different positions, employers, or even industries. Traditional DB plans typically provide much smaller benefits to employees who terminate prior to retirement.

A shift to DC plans in the public sector would increase portability but would also have more significant effects:

- Eliminates retention incentive – Traditional DB plans incentivize employees to stay until retirement eligibility. DC arrangements shift more of the benefits to short-tenured employees and provide significantly smaller benefits to career-length employees compared to a DB plan of similar cost. This incentive is valuable to the employer due to the substantial costs of training new employees.

- Shifts investment and life expectancy risks to employees – Under DC arrangements, the value of employee retirement benefits is heavily dependent on investment performance. Individuals are exposed to market downturns and are not as easily able to capture market recoveries as an ongoing DB plan. Employees will also need to plan the investment and drawdown of their assets during retirement to prevent outliving their savings.

These effects are far more significant than the enhanced portability. If the goal is truly to enhance benefit portability, it would be more effective to provide access to employer-funded benefits upon termination (i.e. an amount larger than the employee contribution balance). This would still maintain the retention incentive since the most valuable benefits would be payable by staying until retirement. Of course, like any other benefit enhancement, this would increase the cost of providing benefits. It would also increase the risk of “leakage” by allowing early access to retirement savings for pre-retirement expenses, which may be viewed as counter to the primary purpose of these plans.

Traditional DB plans also have the advantage of providing employees with mandatory retirement savings through required employee contributions (most DC plans are not mandatory). Employees are always vested in their employee contributions and can roll-over the balances to an IRA or another qualified retirement plan. Many public employers also enhance portability by providing a benefit for service with another public employer, which may be more difficult to do in a defined contribution environment.

Weighing the balance of increased portability with the increased cost and loss of potentially valuable retention tools is one of the many factors for plan sponsors to consider in evaluating whether a shift to defined contribution plans is right for their employees.