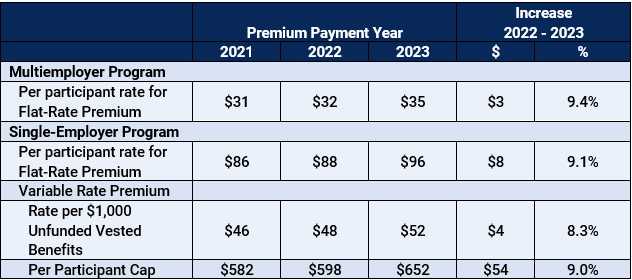

The Pension Benefit Guaranty Corporation (“PBGC”) recently announced the 2023 premium rates for single-employer and multiemployer pension plans. PBGC premium rates for 2023 were derived based on the change in the National Average Wage (“NAW”) index published by the Social Security Administration from 2020 to 2021 – an increase of 8.89%.[1] As a result, for the first time in many years, there are some big increases in premiums, consistent with the current inflationary environment.

In late October the Bureau of Labor Statistics released data showing that compensation for private industry workers increased 5.2% for the 12-month period ending September 30, 2022.[2] This may foreshadow another large increase in premium rates for 2024. Now is a good time for plan sponsors to revisit strategies for how to manage PBGC premium expenses and discuss with their actuary the near-term and longer-term implications of increasing plan administrative expenses.

Strategies for Managing Flat-Rate Premiums

With these large increases set to take effect, there is no better time to do a death audit of your participant population to ensure that premiums are not being paid for deceased individuals who do not have a future benefit entitlement. As an added benefit, a death audit also helps ensure that beneficiaries of deceased participants timely receive the amounts owed to them.

Finding deceased participants will also reduce the plan’s funding liability, and for single-employer plans, can reduce the Vested Benefit Liability on which the Variable Rate Premium is based.

Another option for managing headcount and long-term administrative expenses is to identify participants and beneficiaries who may be entitled to a de minimis (usually $5,000 or less) involuntary lump sum payment from the plan upon severance from service. An outreach program to these individuals to pay them the benefit they are owed will reduce the PBGC premium headcount.

With the recent rise in interest rates, settling retiree benefits through the purchase of a group annuity contract can also remove liability and headcount from the plan. This could be limited to a subset of the retiree population, for example, those with the smallest benefits where the PBGC premium represents a disproportionately high administrative load on the value of their benefits. For multiemployer plans receiving money from the Special Financial Assistance (“SFA”) program, annuity purchases can only be done using non-SFA assets.

Implications for Multiemployer Plans

For many multiemployer plans, the premiums paid annually are not a meaningful share of the overall expenses compared to the cost of professional services and staff wages. Trustees have largely been focused on the known premium increase to $52 per participant in 2031 that was enacted under the American Rescue Plan Act of 2021 (“ARPA”). The move to $35 per participant for 2023 creates a shorter-term problem for plans – especially those that are already facing financial challenges – than the longer-term implication of the big jump coming in 2031 under ARPA.

Higher PBGC premiums (and administrative expenses overall) may lead to an erosion of credit balances more quickly, especially for funds that are not scheduled for bargaining of contribution rates soon and have no means to adjust the cash contributions into the fund to offset these higher expenses. This could impact a fund’s zone status if the effect on projected credit balances is significant enough to change the fund’s long-term financial forecasts.

The premium increase could exacerbate cash flow issues for plans approaching insolvency in the next few years. While SFA-eligible plans that have not yet applied can reflect these higher expected premiums in their projected plan costs, plans that have already applied for SFA money most likely used lower administrative expense assumptions than the newly announced premium rates.

Implications for Single-Employer Plans

Many of the basic strategies for managing headcount discussed above – death audits, lump sum windows, and annuity placement – have historically been used by single-employer plan sponsors as a means of both managing expenses and transferring risk away from the plan sponsor. These large premium increases, combined with rising interest rates, may make an additional wave of risk transfer activity particularly attractive over the next year. The greater the PBGC premium savings, the more quickly such a program pays for itself.

For plans that pay expenses directly from plan assets, the increased premiums will directly increase the minimum required contribution to the plan if there are unfunded liabilities. Plan sponsors may want to simplify their plan administration and shift premium payments from the plan directly to the employer.

Finally, those sponsors with available capital may want to explore options for reducing or eliminating premiums through accelerated funding of contributions. Accelerating funding to the plan to reduce Unfunded Vested Benefit Liabilities generates a guaranteed 5.2% return on the contribution that many sponsors may find it difficult to replicate elsewhere.

With early attention to increasing PBGC premiums, plans can use these methods, among others, to mitigate the effects of these increases on their future funding. Contact your Bolton consultant for more information and to discuss which options make the most sense for your plan.

Contact a Bolton consultant for more information.

[1] The NAW index increased from 55,628.60 in 2020 to 60,575.07 in 2021. The national average wage is derived from the average amount of wages subject to Federal income taxes and contributions to deferred compensation plans, calculated from data collected by the Social Security Administration. The NAW index is updated each year based on the year-over-year change in the national average wage.

[2] By comparison, the 12-month increase for the period ending September 30, 2021, was 4.1%.