In October 2023, the IRS finalized the regulations for mortality tables used for determining present value under single employer defined benefit pension plans and the Current Liability of multiemployer defined benefit pension plans and Cooperative and Small Employer Charity plans (CSEC), effective for plan years beginning on or after January 1, 2024. Additionally, the IRS issued proposed regulations for plan-specific substitute mortality tables for determining present value with a proposed effective date of plan years beginning on or after January 1, 2025.

IRS Mortality Tables for 2024

In past years, the IRS has released four sets of mortality tables for each year:

- the generational mortality table,

- the static mortality table (non-annuitant and annuitant),

- the static mortality table for small plans[1] (combined non-annuitant and annuitant), and

- the applicable mortality table used for 417(e) purposes.

The applicable mortality table issued by the IRS is generally used for lump sum calculations while the other three mortality tables are used for funding valuation purposes.

However, for plan years beginning in 2024, the IRS has only released three sets of tables:

- generational mortality tables,

- static mortality tables for small plans, and

- applicable mortality table used for 417(e) purposes.

The static mortality tables (non-annuitant and annuitant) are no longer permitted for valuations for plan years beginning in 2024.

For multiemployer and CSEC plans, the generational mortality table or the static mortality table can be used to determine the plan’s current liability regardless of whether the plan is a small plan.

Updates to Mortality Tables

The published IRS mortality tables for 2024 reflect an update in the base table from the RP-2006 mortality table to the Pri-2012 mortality table developed by the Society of Actuaries (SOA) in October 2019.

Additionally, the MP-2021 mortality improvement scale used in the 2023 IRS mortality tables has been adjusted to (1) reflect the approximate impact of COVID on mortality improvement[1] and (2) reflect provisions of SECURE 2.0 which capped mortality improvement rates at 0.78% per year for years following 2024.

The Treasury Secretary is required to revise mortality tables at least every 10 years to reflect actual mortality experience of pension plan participants and projected trends in that experience. However, the IRS has been releasing mortality tables each year with new mortality improvement scales released by the SOA. Although it is not required to do so, these annual updates from the IRS allow plan sponsors to reflect general trends in longevity more timely than under the required every 10 year updates.

Impact of New Mortality Tables on Single Employer Plans

The impact of the new IRS mortality tables for 2024 will vary for each plan based on the plan’s demographics and the IRS mortality table previously used for funding purposes. Contrary to the broader trend of future mortality improvements extending expected lifetimes, expected lifetimes under the IRS mortality tables for 2024 are generally shorter than those under the IRS mortality tables for 2023. Depending on the plan’s demographics, this will roughly translate to a decrease in the funding target liability of about 1.0% to 2.5% and a decrease in the target normal cost of about 0.5% to 2.5%. However, plans with younger demographics could see increases in the liability and normal cost when changing from a static table to the generational mortality table.

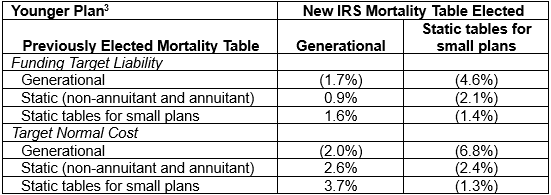

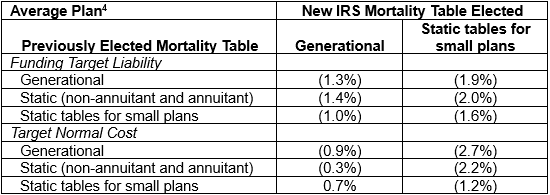

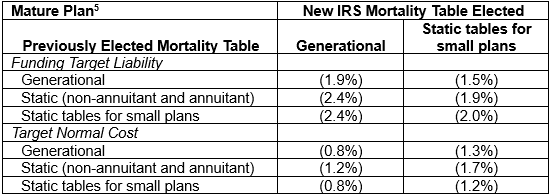

The table below provides a summary of the impact, depending on the previously elected IRS mortality table, for three sample plans with different demographics: younger plan (high duration), average plan (medium duration), and mature plan (low duration).

The decrease (or increase for younger plans) in the plan’s Funding Target Liability and Target Normal Cost for funding valuation purposes as a result of the change in mortality tables can reduce (or increase for younger plans) the Plan’s:

- Minimum Required Contribution,

- Quarterly Contribution Requirements,

- Maximum Deductible Contribution (if applicable),

- PBGC variable-rate premium (if not impacted by participant caps).

Additionally, the new IRS 417(e) mortality tables for 2024 reduce the value of lump sums by about 1.0% to 2.0%. This can make the de-risking strategy of providing lump sums to participants more attractive. However, the interest rates that are locked in for determining the value of lump sums can have a greater impact on the overall cost of de-risking than the update to the applicable mortality table.

If you are a plan sponsor and interested in knowing the impact on your plan, contact one of our consulting actuaries to discuss.

Plan Sponsor Elections

Plan sponsors of plans with less than 500 participants (considered small plans for this purpose) must make an election before filing the 2024 Form 5500. The election should identify the IRS mortality table to be used for the 2024 plan year which can either be the generational mortality table or the static mortality table for small plans. For plans with at least 500 participants that do not use plan-specific substitute mortality tables, there is no election required as the generational mortality table released by the IRS is the only available option.

This final regulation has an effective date of plan years beginning on or after January 1, 2024. Our consultants can help you through the election process.

Plan-Specific Substitute Mortality Tables

The IRS allows for single employer pension plans to develop a substitute mortality table to reflect actual mortality experience of the plan’s participants if the plan has enough data to make their own mortality experience “credible”. Generally, plans with fewer than 5,000 participants do not have enough data to develop their own mortality tables. For those plans that qualify, the substitute mortality table can be used to determine the plan’s Funding Target Liability and Target Normal Cost for the purpose of determining the plan’s Minimum Required Contribution.

The IRS has issued new proposed regulations for the plan-specific substitute mortality tables which include additional rules regarding the use of mortality experience data for the COVID-19 pandemic period. This proposed regulation has a proposed effective date of plan years beginning on or after January 1, 2025. Contact us if you would like more details on plan-specific substitute mortality tables.

[1] For this purpose, a small plan has less than 500 participants as of the valuation date.

[2] For this purpose, mortality improvements during 2020 through 2023 were eliminated while retaining mortality deterioration during this period.

[3] Younger Plan: actives average age of 35 and 60% of the liability, terminated vested average age of 40 and 30% of the liability, and retirees average age of 68 and 10% of the liability. Participants are assumed to be split 50% male and 50% female with non-retirees assumed to retire at age 65.

[4] Average Plan: actives average age of 55 and 16% of the liability, terminated vested average age of 56 and 37% of the liability, and retirees average age of 71 and 47% of the liability. Participants are assumed to be split 50% male and 50% female with non-retirees assumed to retire at age 65

[5] Mature Plan: actives average age of 62 and 5% of the liability, terminated vested average age of 65 and 32% of the liability, and retirees average age of 78 and 63% of the liability. Participants are assumed to be split 50% male and 50% female with non-retirees assumed to retire at age 65.