On March 17, 2023, the IRS released a set of frequently asked questions (FAQs) to address whether certain costs related to general health, nutrition and wellness are medical expenses that can be paid or reimbursed by a health savings account (HSA), health flexible spending account (FSA) or health reimbursement arrangement (HRA).

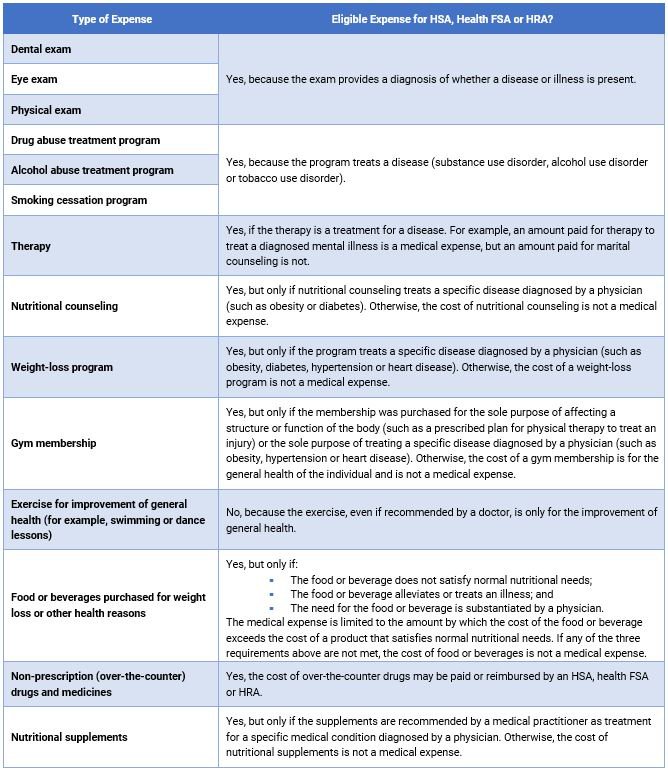

In general, only expenses that qualify as medical care under Internal Revenue Code (Code) Section 213 are eligible to be paid or reimbursed under an HSA, health FSA or HRA. The FAQs provide that costs for the following are medical expenses:

- Dental exams, eye exams and physical exams;

- Programs to treat a drug-related substance use disorder or alcohol use disorder; and

- Smoking cessation programs.

The FAQs also address under what circumstances the costs of therapy, nutritional counseling, weight-loss programs, gym memberships and nutritional supplements can be considered medical expenses that may be paid or reimbursed under an HSA, health FSA or HRA.

Medical Expenses – Code Section 213

Medical expenses under Code Section 213 are eligible to be paid or reimbursed under an HSA, FSA or HRA. Medical expenses are the costs of diagnosis, cure, mitigation, treatment or prevention of disease, and for the purpose of affecting any part or function of the body.

These expenses include payments for legal medical services rendered by physicians, surgeons, dentists and other medical practitioners. They include the costs of equipment, supplies and diagnostic devices needed for these purposes. They also include the costs of medicines and drugs that are prescribed by a physician.

Medical expenses must primarily alleviate or prevent a physical or mental disability or illness. They do not include expenses that are merely beneficial to general health.

Employer Action Steps

The IRS released these FAQs as part of the federal government’s National Strategy on Hunger, Nutrition and Health. While they do not include any new guidance, they provide helpful reminders of when expenses related to general health, nutrition and wellness can be reimbursed by an HSA, health FSA or HRA. Employers that sponsor health FSAs or HRAs should review their plan designs to ensure that only medical expenses are eligible to be paid or reimbursed.

IRS FAQs

The IRS’ FAQs provide guidance on whether certain expenses related to general health, nutrition and wellness are medical expenses that can be paid or reimbursed by an HSA, health FSA or HRA.

Please Note: The information contained in this article is not legal advice and should not be relied upon or construed as legal advice. This article for general informational purposes only and does not purport to be complete or cover every situation. Please consult your own legal advisors to determine how this article may affect you.